trust capital gains tax rate uk

18 and 28 tax rates for individuals the tax rate you use depends on the total amount of your taxable income so you need to work this out first 28. 20 for trustees or for.

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

The long-term capital gains tax rate is zero percent 15 percent as well as 20 percent based on your income tax taxable and your filing status as well as what number of capital gains you have earned.

. Trustees pay 10 Capital Gains Tax on qualifying gains if they sell assets used in a beneficiarys business which has now ended. The income used to pay the trust management expenses is liable to the basic rate tax 75 or 20 but not the additional rate. The Trust would pay tax of.

Home Tax Bracket Rates Tax Rate On Capital Gains In A Trust Tax Rate On Capital Gains In A Trust May 4 2021 October 4 2021 Tax Bracket Rates by admin. Although irrevocable trusts are complex trusts which means they can accumulate income they make on trust assets the trustees normally reduce taxes by distributing all the trust income each year to the beneficiaries in the year the. The following Capital Gains Tax rates apply.

1000 at a rate of 20 200. In the event that a home gains is sold you will be taxed on the gains principal value at 18 or at 28 if the taxed amount is greater. Total tax 5375.

At basically 13000 in income they hit the highest tax rate. Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with. 11500 at a rate of 45 5175.

Irrevocable trusts have a major tax issue. The trustee rates of capital gains tax of 20 and income tax of 45 have refocused this need. Capital gains are charged at a rate of 20 28 for residential property.

A 10 tax rate on your entire capital gain if your total annual income is less than 50270. In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. Targeted at offshore trusts to ensure that UK income tax and capital gains tax cannot be avoided using offshore trusts.

Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. Capital gains can arise in the trust on the disposal of trust assets or the appointment of assets to beneficiaries. In general they are less favorable than the rates for short-term capital gains.

12 Offshore trusts The term offshore trust although not legal or statutory is universally used to. The 75 tax on the dividends used to pay the expenses does have to paid it is just not added to the tax pool. In certain cases it may be beneficial to shift the tax burden of capital gains from the trust to the beneficiary.

Your entire capital gain will be taxed at a rate of 20 or 28 in the case of the residential property provided your yearly income exceeds 50270. Such trusts however can still afford tax-planning benefits particularly for those domiciled outside the United Kingdom. As from April 2016 Capital Gains Tax rates vary depending on the nature of the asset disposed of.

This section addresses income tax capital gains tax and inheritance tax for the trustees and where applicable the beneficiaries and settlors. Work out your tax - GOVUK Skip to main content. Current Capital gain tax rates and allowance In UK.

This is subject to change by the government. Once a trust reaches 12150 of taxable income capital gains will be taxed at a marginal rate of 20. 20 basic-rate taxpayers 40 for higher-rate taxpayers 45 for additional-rate taxpayers If youd like to know more about how income tax is payable on unit trusts get in touch and we will arrange for an advisor we work with to contact you directly.

Taxes on capital gains for 2021-22 and 2020-21 will be adjusted. Investment income including capital gain that is not distributed to the. The tax on capital gains for long-term rate is zero per cent fifteen percent and 20 percent based on your taxable income filers status and also what number of gains youve earned.

Residential Property is taxed at 28 while other chargeable assets are taxed at 20. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets. Any gains arising on trust assets are reduced by an annual exemption of 6150 202021 divided equally by the number of trusts set up by the same individual in existence in the relevant tax year.

Trusts and Capital Gains. Capital gains tax is calculated using the same rules that apply to individuals but they typically only have half an individuals annual exemption. Tax rates on capital gains are set for 2021-22 and 2020-21.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2020 to 2021 tax year. What Is The Capital Gains Tax Rate For 2021 Uk. Use this guidance to help you decide if Capital Gains Tax is due and how much you need to pay.

If a vulnerable beneficiary claim is made the trustees are taxed on. The remaining gains are taxed at 20 unless the gain is on a residential property interest where the rate would be 28. Distribution of Capital Gains.

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

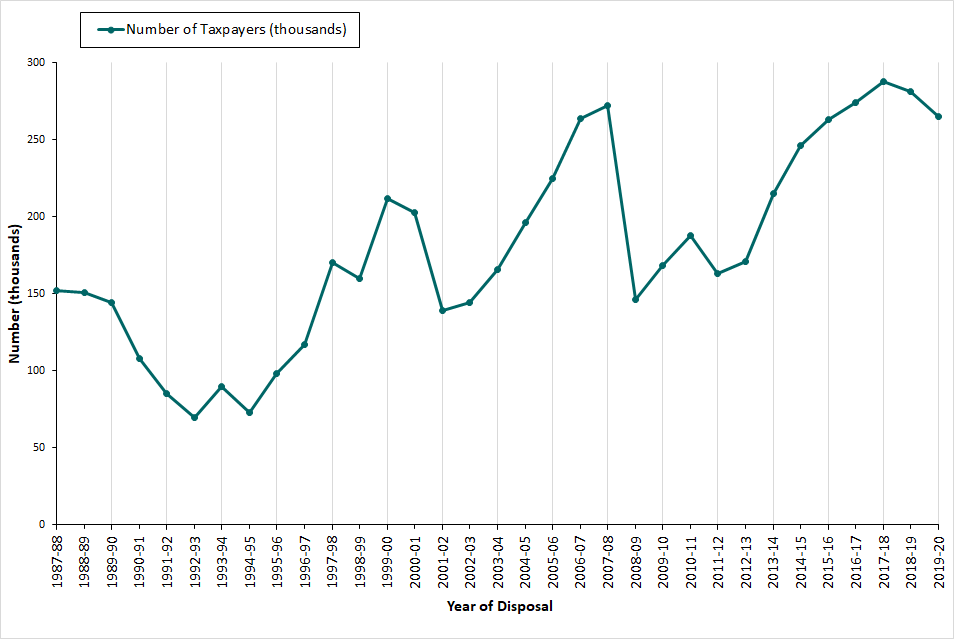

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Smart Investors Guide To Elss Mutual Funds Capital Gains Tax Tax Deductions Income Tax

The States With The Highest Capital Gains Tax Rates The Motley Fool

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is Capital Gains Tax And When Are You Exempt Thestreet

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Commentary Gov Uk

How Much Is Capital Gains Tax Times Money Mentor

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Top 10 Highest Paid Athlete In The World 2021 Https Www Moneyinternational Com Top 10 Highest Paid Athlete 2021 In 2021 Athlete Mohamed Salah Liverpool Kylian Mbappe

How To Avoid Or Cut Capital Gains Tax By Using Your Tax Free Allowance Getting An Isa And More Lovemoney Com

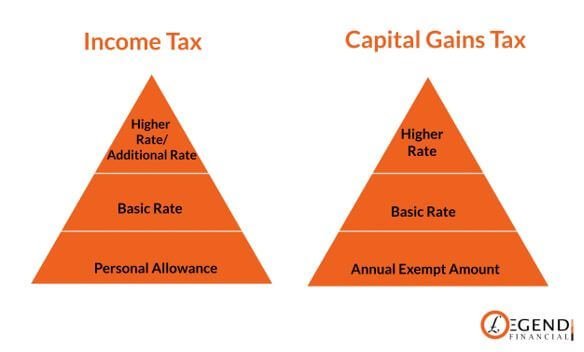

How Much Is Capital Gains Tax On Property Legend Financial

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor