south dakota vehicle sales tax calculator

This includes the rates on the state county city and special levels. Average Local State Sales Tax.

The Consumer S Guide To Sales Tax Taxjar Developers

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including.

. Maximum Possible Sales Tax. Rate search goes back to 2005. Our online services allow you to.

Review and renew your vehicle registrationdecals and license plates. 0 for electric vehicles. Vehicle Tax Costs.

7 local rate on first 1600 275. The average cumulative sales tax rate in Tabor South Dakota is 45. Within Sioux Falls there are around 14 zip codes with the most populous zip code being 57106.

The South Dakota Department of Revenue administers these taxes. One field heading labeled Address2 used for additional address information. The municipal gross receipts tax can be imposed on alcoholic beverages eating establishments.

Law enforcement may ticket for driving on expired plates. The state in which you live. Ad Lookup Sales Tax Rates For Free.

The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. For additional information on sales tax please refer to our Sales Tax Guide PDF. Tabor is located within Bon Homme County South DakotaWithin Tabor there is 1 zip code with the most populous zip code being 57063The sales tax rate does not vary based on zip code.

With local taxes the total sales tax rate is between 4500 and 7500. Vehicle tax or sales tax is based on the vehicles net purchase price. 4 Motor Vehicle Excise Manual.

North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 096 on top of the state tax. The type of license plates requested. In South Dakota an ATV MUST be titled.

South Dakotas state sales tax rate is 450. 0 through 9 years old. The Lead South Dakota Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Lead South Dakota in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Lead South Dakota.

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. The South Dakota SD state sales tax rate is currently 45. The vehicle is exempt from motor vehicle excise tax under SDCL 32-5B-2.

Counties are allowed to impose an administrative fee for out-of-state and resident applicants titling motor vehicles entirely by mail. This includes the following see. The average cumulative sales tax rate in Sioux Falls South Dakota is 65.

Opt-in for email renewal and general notifications. Sioux Falls is located within Minnehaha County South Dakota. This means that depending on your location within North Dakota the total tax you pay can be significantly higher than the 5 state sales tax.

Depending on local municipalities the total tax rate can be as high as 65. If you are unsure call any local car dealership and ask for the tax rate. They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax.

Tax and Tags Calculator. Other local-level tax rates in the state of South Dakota are quite complex compared against local-level tax rates in other states. Additional address information must be in a column labeled Address2 for file to.

Find out the estimated renewal cost of your vehicles. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Motor vehicles exempt from the motor vehicle excise tax under.

Just enter the five-digit zip code of the. South Dakota State Sales Tax. The Motor Vehicle Division provides and maintains your motor vehicle records.

Its fairly simple to calculate provided you know your regions sales tax. Dealership employees are more in tune to tax rates than most government officials. Once you have the tax.

The state sales and use tax rate is 45. The county the vehicle is registered in. Whether or not you have a trade-in.

150 for echeck or 225 for debit or credit card. Moral issues in society today. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This includes the sales tax rates on the state county city and special levels. The South Dakota vehicle registration cost calculator is only an estimate and does not include any taxes fees from late registration and trade in fees. Interactive Tax Map Unlimited Use.

One field heading that incorporates the term Date. South Dakota Sales Tax. In addition cities in South Dakota have the option of collecting a local sales tax of up to.

Purchase new license plates. Costs include the registration fees mailing fees mailing fee is 1 for each registration renewed and a processing fee. Municipalities may impose a general municipal sales tax rate of up to 2.

New car sales tax OR used car sales tax. South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1817 on. Furthermore taxpayers in South Dakota do not need to file a state tax return.

SDL 32-5-2 are also exempt from sales tax. Maximum Local Sales Tax. United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state.

Missouri Car Sales Tax Calculator

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

The Consumer S Guide To Sales Tax Taxjar Developers

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Sales Taxes In The United States Wikiwand

Sales Tax Calculator Credit Karma

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Arizona Sales Tax Small Business Guide Truic

Item Price 89 99 Tax Rate 9 Sales Tax Calculator

How Is Tax Liability Calculated Common Tax Questions Answered

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

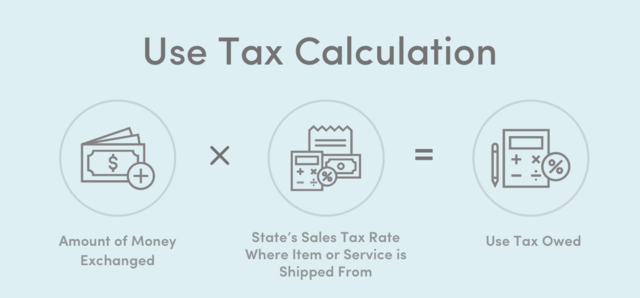

Sales And Use Tax What Is The Difference Between Sales Use Tax